Your Gateway to Space

Satellite, Lunar and Deep Space Communications

Your Gateway to Space

Satellite, Lunar and Deep Space Communications

Our Core Services

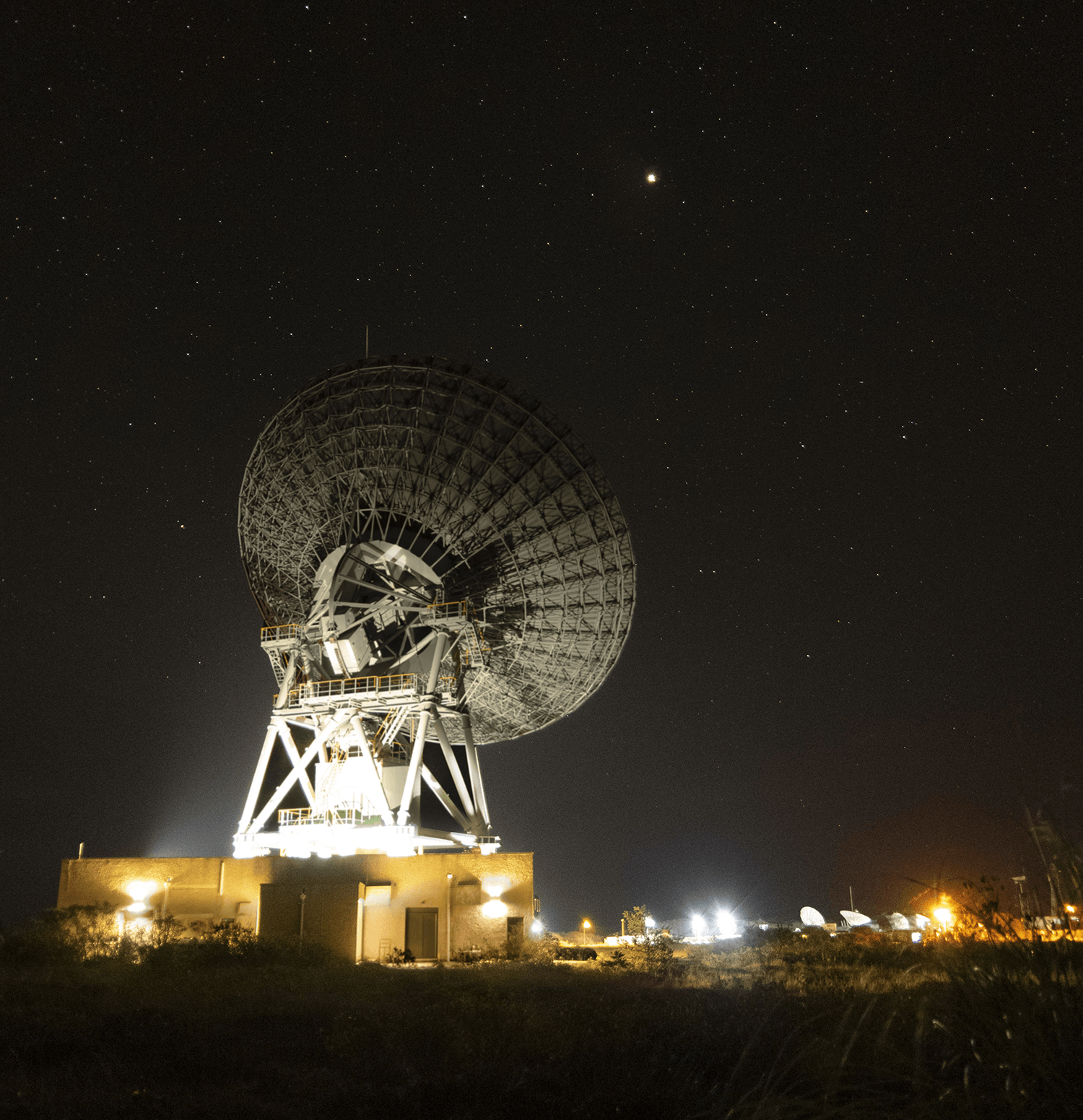

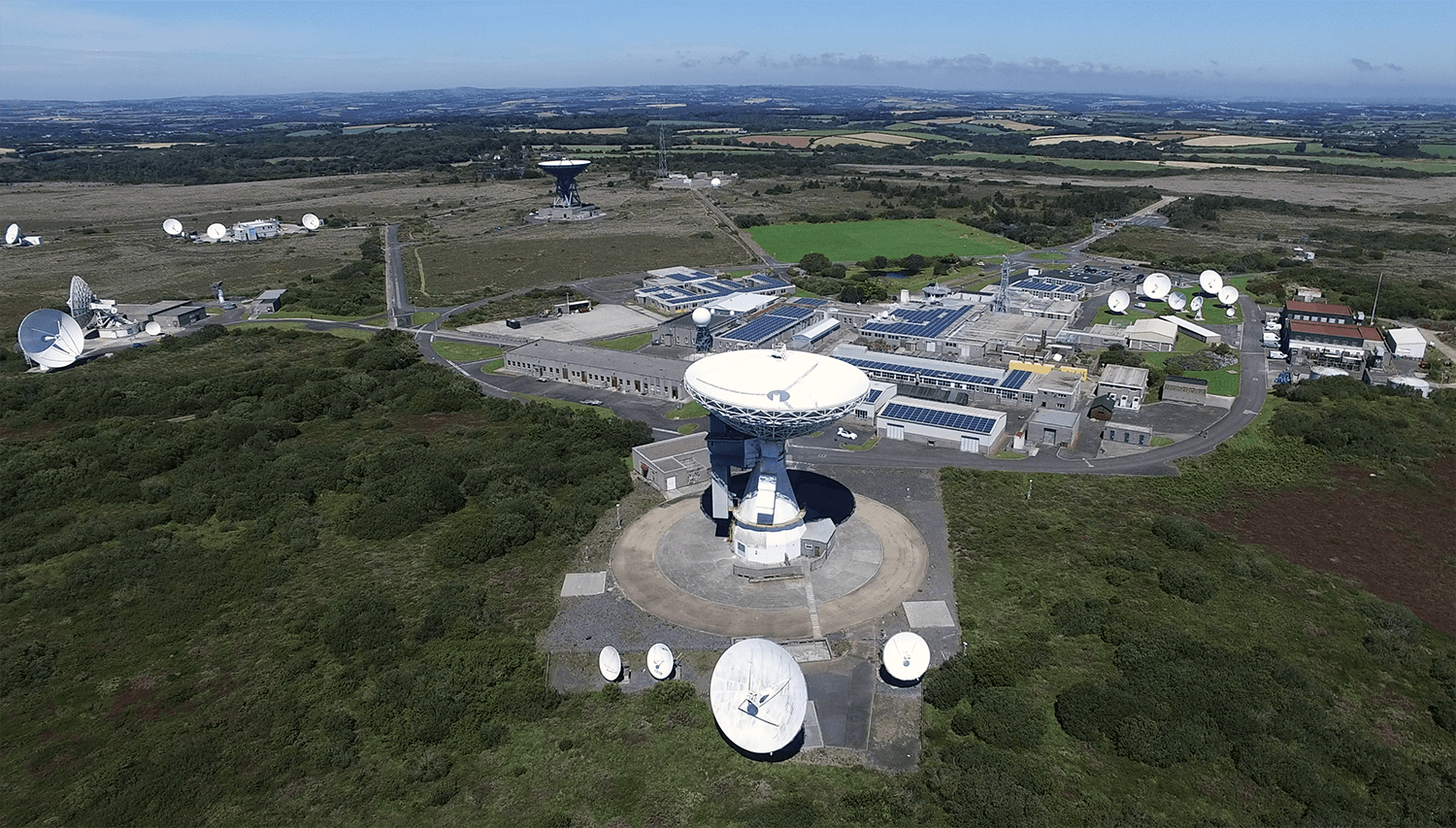

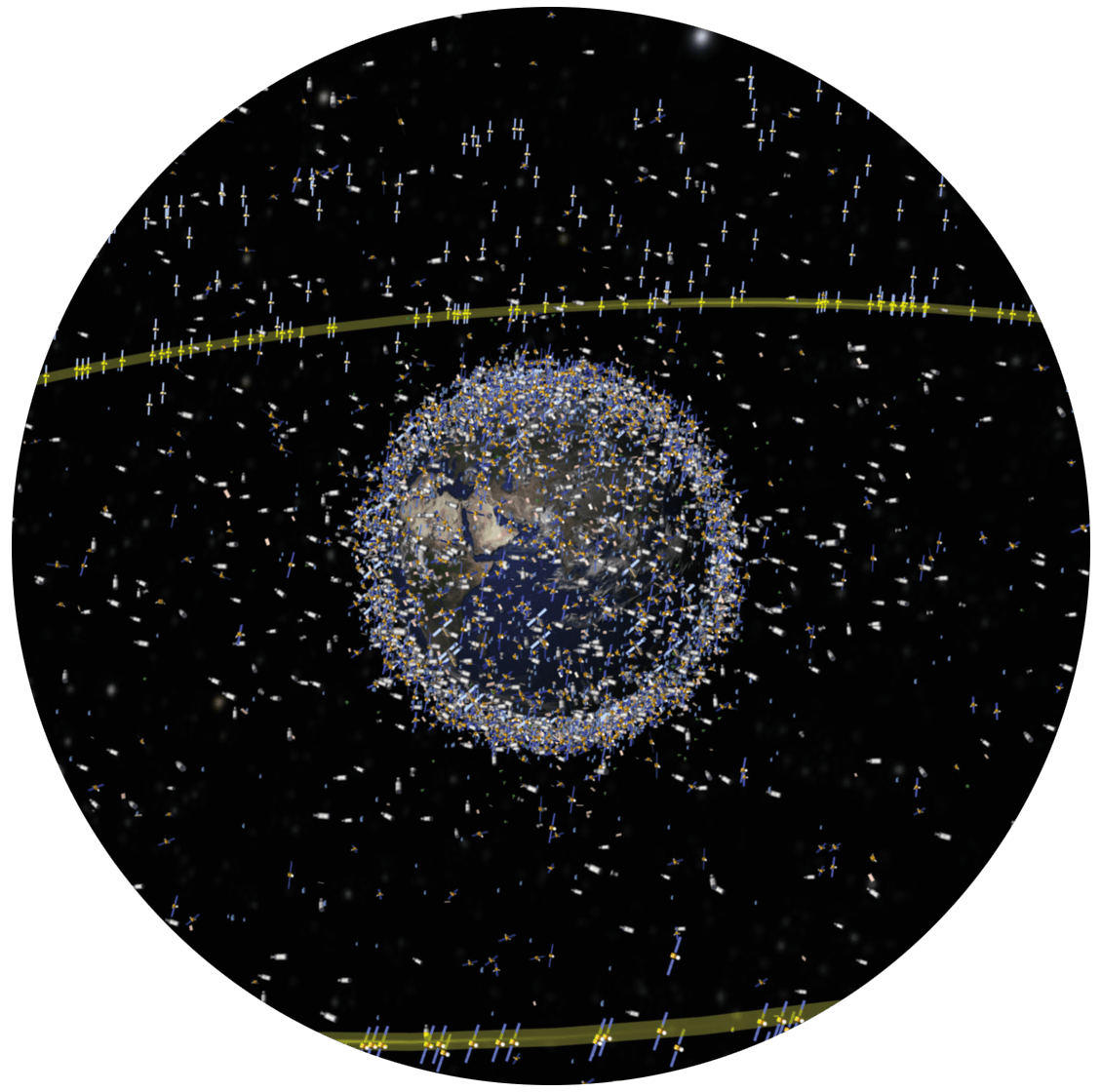

Goonhilly are proud to have established the world’s first private deep space communications network.

Additional services such as radio astronomy are supported on our cryogenically-cooled 30m antenna, GHY-3. Together, the antennas will form part of Goonhilly’s global deep space network, as the company expands internationally.

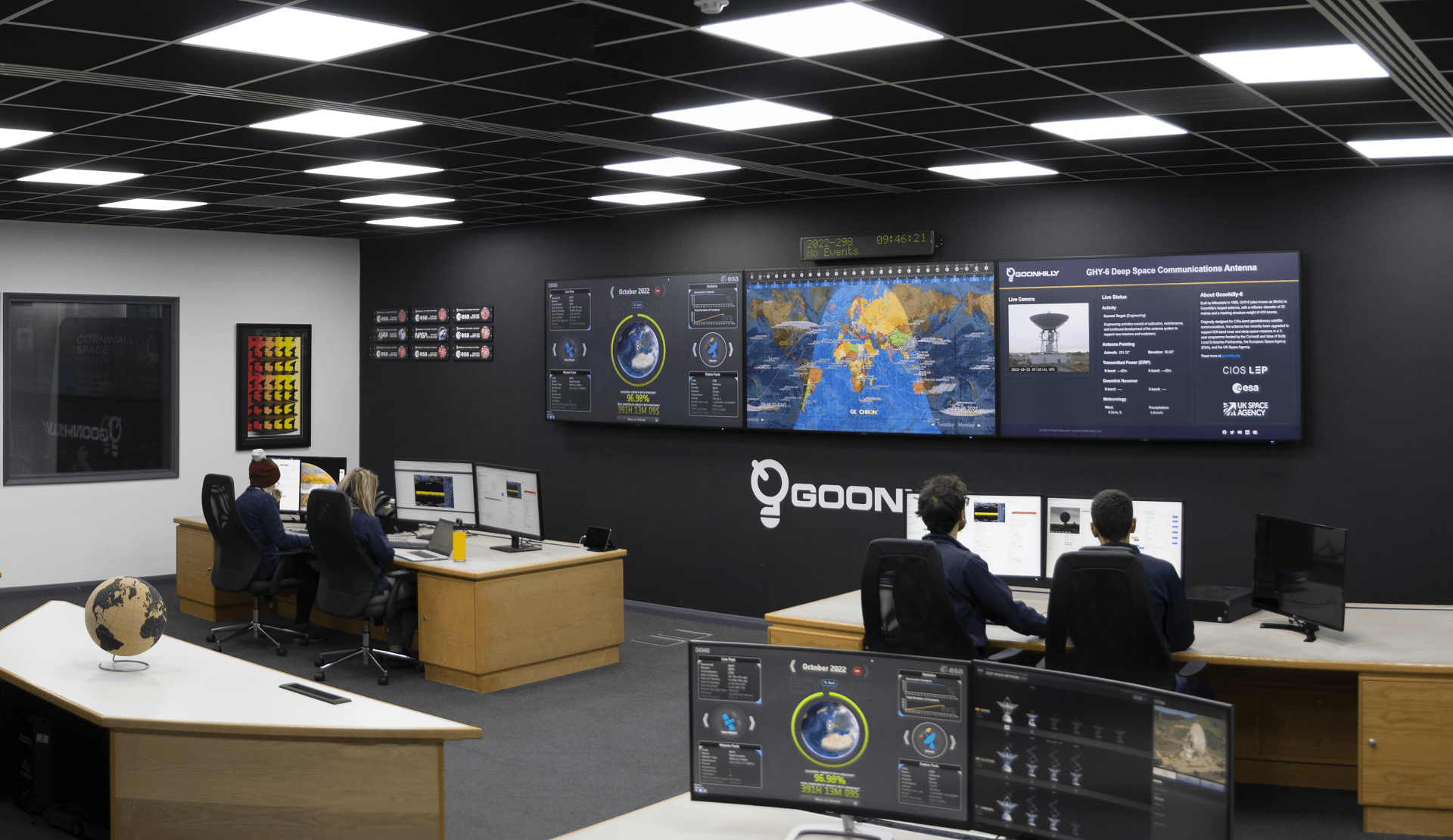

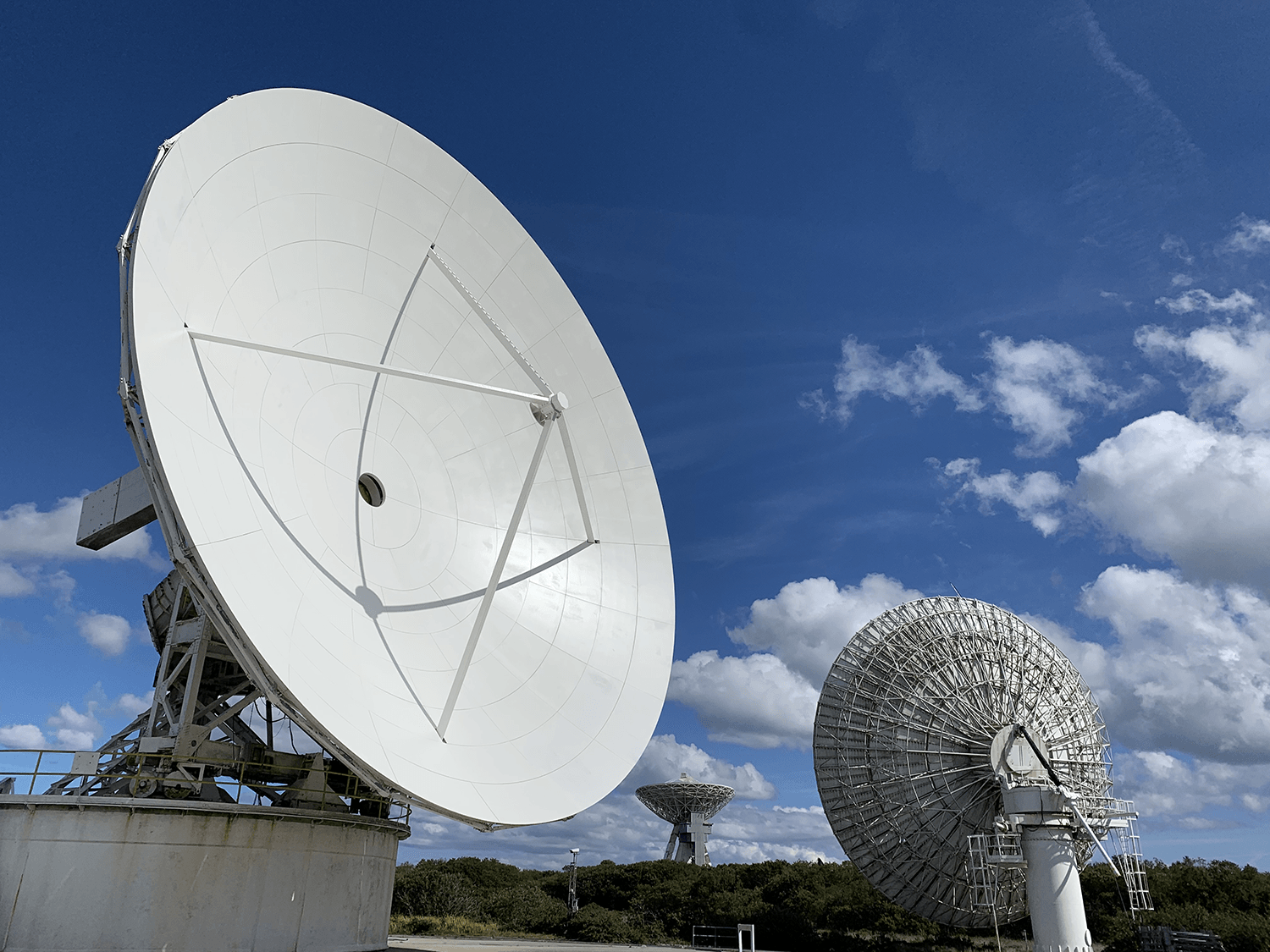

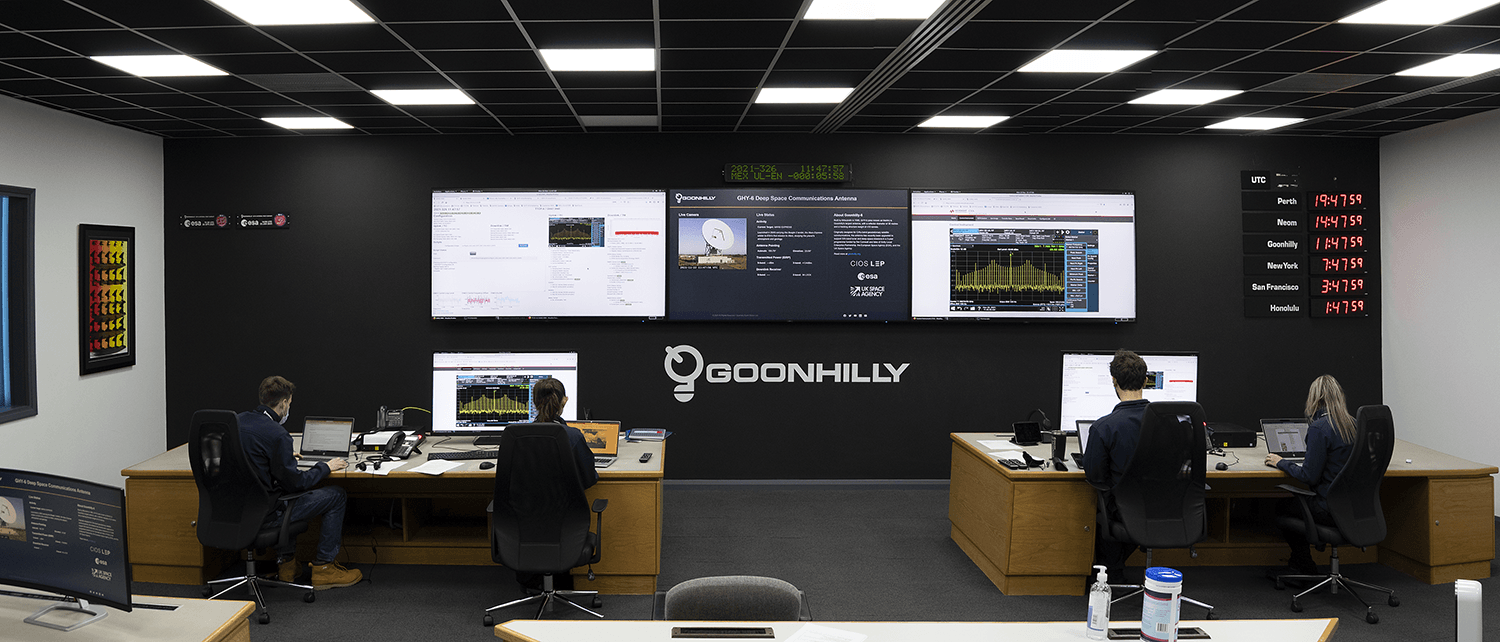

Operating as global industry leaders for more than 60 years, and as a trusted ground station of choice for all the world’s major space companies, there’s no one better suited to providing the satellite communication services that your organisation requires.

Benefitting from resilient large-scale networks and infrastructure, expert 24/7 support, and an optimal geographical location, we offer a wide range of satellite services including uplink and broadcast, gateway operations, TT&C, carrier monitoring, and more.

Our Core Services

Goonhilly are proud to have established the world’s first private deep space communications network.

Additional services such as radio astronomy are supported on our cryogenically-cooled 30m antenna, GHY-3. Together, the antennas will form part of Goonhilly’s global deep space network, as the company expands internationally.

Operating as global industry leaders for more than 60 years, and as a trusted ground station of choice for all the world’s major space companies, there’s no one better suited to providing the satellite communication services that your organisation requires.

Benefitting from resilient large-scale networks and infrastructure, expert 24/7 support, and an optimal geographical location, we offer a wide range of satellite services including uplink and broadcast, gateway operations, TT&C, carrier monitoring, and more.

Additional Services

Additional Services

Additional Services

How can we help?

We offer space communication solutions to the Moon and beyond.

Get in touch today to discover how Goonhilly can support you.

We are proud to work with the following organisations:

All Rights Reserved • Goonhilly Earth Station Ltd

All Rights Reserved • Goonhilly Earth Station Ltd

Goonhilly Downs, Helston, Cornwall, UK. TR12 6LQ

Terms of Use • Privacy Policy •

Sitemap •

Contact

Goonhilly Earth Station Ltd (Company No-06896077) VAT No: 109807310 - Registered office: Goonhilly Downs, Helston, Cornwall, TR12 6LQ.